This extensive guide will explore Fibonacci Forex Trading Strategy and Fibonacci (Fib) retracements in great detail, establishing why they are important in trading, their role in the creation of a Fibonacci trading strategy, the strategies that can be used with fibonacci retracements, how to use fib retracement, the application of fibonacci extensions, and much, much more!

In the Fibonacci sequence of numbers, after 0 and 1, every number is the sum of the two previous numbers, and looks something like this: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610. As you can see, this sequence can continue to extend to infinity. Every number is approximately 1.618 times bigger than the former number.

The Golden Ratio in Forex The figure 1.618 is called 'Phi', which also known as the Golden Ratio. The exact inverse of 1.618 is 0.618.

Fibonacci retracements are used to create the Fibonacci trading strategy. This term has a connection with areas of support and resistance (i.e when the price stops going higher, or when the price stops going lower). Therefore, from what is described previously, one can conclude that Fibonacci retracement is the potential retracement of a financial asset's movement in price.

Retracements use horizontal lines in an attempt to indicate areas of support or resistance at the key Fibonacci indicator levels, prior to the moment when it continues in the original direction. Furthermore, these levels are generated by drawing a trendline between two extreme points, and then dividing the vertical distance by the key Fibonacci ratios, which are: 23.6%, 38.2%, 50%, 61.8% and 100%.

As Fibonacci retracements have proven to be useful in Forex, as they can be used to create a viable Fibonacci Forex trading strategy to supplement trading. The aim of this article is to explain the advantages of this strategy, and to explore the basic steps of creating a Fibonacci strategy with some examples.

Forex Fibonacci levels applied within Fibonacci Forex retracements in trading are not actually based on numbers in the sequence. They are instead obtained from the mathematical relationships between numbers in the sequence. The main basis of the golden Fibonacci ratio (which is 61.8%) comes from dividing the number in the Fibonacci series by the certain number that succeeds it. For instance, 89/144 = 0.6180.

In addition, the 38.2 ratio is acquired from dividing a certain number in the Fibonacci series by the number two places to the right (e.g 89/233 = 0.3819). The 23.6 ratio is derived from dividing a number in the Fibonacci series, by the number three places to the right, for example: 89/377 = 0.2360. Fibonacci levels are illustrated by taking high and low points on a certain chart, and then marking the main Fibonacci ratios of 23.6%, 38.2%, and 61.8% horizontally, to generate a grid. In turn, those horizontal line are used to determine possible price reversal points.

The 50% Retracement Level

The 50% retracement level is commonly included in the Fibonacci levels' grid that can be drawn applying charting software. Since the 50% retracement level is not based on a concrete Fibonacci number it is generally viewed as a significant reversal level, peculiarly recognised in Dow theory, as well as in the work of W.D Gann.

There are a number of strategies which can be used to trade with Fibonacci FX retracements, although some are more suitable than others.

These strategies are:

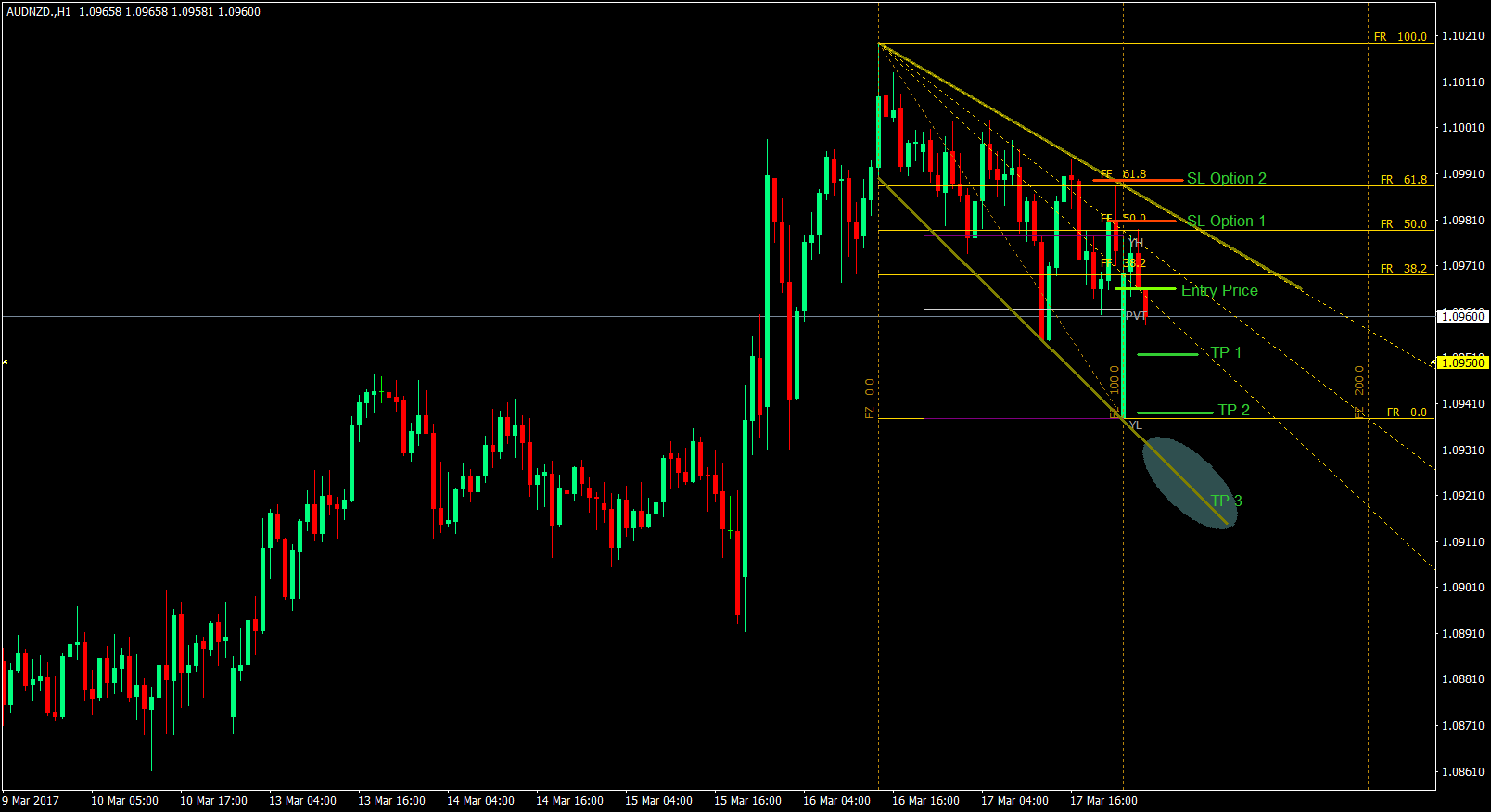

Forex traders utilise Fibonacci FX retracements to spot where to position orders for market entry, for either taking profits, or for placing stop-loss orders. These retracements indicate key levels of resistance and support. Fibonacci levels are usually calculated after the FX market has made a particularly significant movement either up or down, and accordingly appears to have flattened out at a particular price level.

Traders organise the key Fibonacci levels of 38.2%, 50% and 61.8%. To do so, they draw horizontal lines across a concrete chart at these price levels, to point out areas where the market may actually retrace to, prior to resuming the general trend formed by the initial big price movement. Fibonacci retracement levels are regarded as significant when the market has approached or has surpassed a great price support or resistance level.

The 50% level is not technically part of the Fibonacci number sequence, although it is included thanks to widespread experience in Forex trading of a market retracing approximately half a major move prior to resuming, and consequently continuing its trend. We're now going to look at some examples of which Forex strategies traders often apply when using Fibonacci levels:

While joining a sell position around the top of the big move, traders often utilise Fibonacci levels in Forex to determine take-profit targets. This is in case the market retraces near to one of the Fibonacci levels, and after that resumes its preceding movement. That works thanks to utilizing the higher Fibonacci levels of 161.8% and 261.8%, to indicate possible future support, as well as resistance levels. However, that is only in the case of the market moving beyond the high or low that was achieved before the retracement.

Some currency traders believe in Fibonacci retracements as a way of identifying small price correlations, and in determining areas of support and resistance. Technically, the retracements themselves are ratios that are based on the mathematical concepts of the Fibonacci sequence. This sequence is utilised to guess the extent of correlations in normal market waves. There are many popular technical indicators that are applied in conjunction with Fibonacci levels, including candlestick patterns, volume, trendlines, moving averages and momentum oscillators.

Forex traders will know that the most common retracement levels are 38.2% and 61.8%. As a matter of fact, after a strong bear or bull movement, a retracement level in a Fibonacci Forex trading system can be exploited to predict the extent of any correlations, pullbacks, and continuation patterns. If a retracement has actually proven to be effective in determining support or resistance levels within the historical price patterns of a particular security, currency traders can then apply breakout strategies if they wish to locate entry-exit positions.

For instance, if a price rises from $60 to $85, and then retraces to $72.50 prior to rising again, the Fibonacci retracement level is said to be 50%. Indeed, this price point forms a new line of support, and the 50% level turns out to be a significant indicator for the security's future price movements. The underlying principles behind Fibonacci trading and the Forex Fibonacci strategy are not necessarily experiential, so they are subject to alterations based on the trading instrument.

Bear in mind, that you should not place trades just due to the fact that a price has reached a common retracement level. In fact, the confirmation is necessary to make sure that the price does not continue to decline, and that the general trend is likely to continue. Otherwise, you may improperly trade into the wrong side of a reversal.

As we have specified above, currency traders employ Fibonacci retracements to determine where to place orders for market entry. In addition, they may identify places for taking profits and for stop-loss orders. As for Fibonacci levels, they are typically employed in order to determine and trade off of support and resistance levels. In every Fibonacci Forex strategy, Fibonacci levels are most frequently calculated after a market has made a large move up or down, and appears to have flattened out at a particular price level.

As you know, traders plot the key Fibonacci retracement levels of 38.2%, 50% and also 61.8%. This is achieved by drawing horizontal lines across a chart at those price levels, to pinpoint areas where the market can retrace, prior to resuming the general trend formed by the initial large price movement. However, that is not all - the Fibonacci levels are regarded as immensely important when a market has either reached, or approached a major price support or resistance level.

Technically, the 50% level is not really part of the Fibonacci number sequence, but it is included due to the general experience in the trading of a market, retracing about half a major movement prior to resuming and continuing its trend. There are a few strategies currency traders apply using Fibonacci levels. One is through buying near the 38.2% retracement level, with a stop-loss order placed a little below the 50% level. The next Fibonacci trading strategy is by purchasing near the 50% level, with a stop-loss order placed slightly below the 61.8% level.

You can also use Fibonacci levels when entering a sell position near the top of a large move, using the Fibonacci retracement levels as take-profit targets. The last example here is the following: If the market retraces close enough to one of the Fibonacci levels and then resumes its previous move, traders can use the higher Fibonacci levels of 161.8% and 261.8% to define possible future support and resistance levels, if the market goes beyond the high or low that was reached before the retracement.

When it comes to Fibonacci levels, you can address the question of how to use Fibonacci retracement to predict Forex market. They can be utilised to predict potential support or resistance areas, where Forex traders can join the market with a view to catching the beginning of an initial trend. A Fibonacci extension can favour this strategy by giving Forex traders Fibonacci based profit targets.

Additionally, Fibonacci extensions comprise of levels drawn beyond the ordinary 100% level. This can be exploited by Forex traders in order to project areas that assemble good potential exits for their trades in the direction of the trend. As we have previously mentioned, the major Fibonacci extension levels include: 161.8%, 261.8% and 423.6%.

When a market has moved a significant distance, especially if the market appears to have topped or bottomed out at a major support or resistance level, Fibonacci retracement lines are frequently plotted on a chart by technical traders, to determine potential levels at which the market might retrace.

If the market price has moved higher, those horizontal lines displayed on the chart are considered as potential support levels and price levels where the retracement can end - and where the market might resume an uptrend. In the reverse situation, the Fibonacci levels would be regarded as resistance levels in a market that has actually decreased in price.

The key Fibonacci retracement levels encompass the 38.2%, the 50% level, and also the 61.8% levels. Although the 50% level is not a true Fibonacci number, it is often included in the Fibonacci sequence, due to the belief that a market frequently retraces nearly half of a move prior to resuming its overall trend. We would now like to provide you with some additional strategies using Fibonacci retracements that you may find useful:

The first Fibonacci trading system we'll look at is when a currency trader is looking for an entry point into a particular market that has made an important move to the upside. They might place limit orders in an attempt to buy near the 38.2% or 50% retracement levels, with the respective stop-loss order being placed below the following Fibonacci level down. For instance, a desire to buy near the 50% level, with a stop under the 61.8% level.

The second strategy is that if a Forex trader has recognised a market reversal following a significant move up, and then accordingly enters a sell position, they may exploit Forex retracements as profit targets. The last Forex Fibonacci strategy - a substantial violation of the 61.8% level - is frequently regarded as a sign of complete market reversal of direction. If this occurs, currency traders may enter short positions, anticipating to move much lower.

Fibonacci retracements are mainly used as part of a particular trend trading strategy. In scenarios like this, Forex traders locate a retracement occurring within a trend, and consequently try to make low risk entries in the initial trend's direction, by utilising Fibonacci levels. In other words, traders applying this strategy expect that the price has a high chance of bouncing from the Fibonacci levels back in the direction of the initial trend. Additionally, the possibility of a reversal extends where there is a convergence of technical signals by the time the price reaches a Fibonacci level.

As mentioned earlier, other common technical indicators that are applied along with Fibonacci levels include volume, trendlines, momentum oscillators, moving averages and candlestick patterns. A substantial number of confirming indicators used relate to a more vigorous reversal signal. Forex Fibonacci retracement is based on the diversity of financial instruments involving foreign exchange, stocks, and commodities, and is used in multiple time-frames.

Nonetheless, like with other technical indicators, the predictive value is proportionate to the timeframe applied, with bigger weight given to relatively longer timeframes. This leads us to the point that a 38% retracement on a weekly chart is a much more significant technical level in comparison to a 38% retracement on a 5-minute chart.

Using Fibonacci in Forex trading is a good way to potentially increase your profits. Fibonacci levels frequently mark reversal points with a good degree of accuracy. That being said, they can be difficult to trade, and traders often prefer to utilise the levels as tools within a broader Forex strategy, which focuses on areas of low risk, as well as high potential reward trade entries. Strategies of trading retracements are quite popular, and you will undoubtedly find a suitable one to meet your trading needs. As a consequence, you should know how to use Fibonacci retracement in Forex.

It is no secret that Fibonacci retracements can be of great value in successful Forex trading. Knowing how to set, draw, and consequently apply them is of paramount importance. Besides enriching your technical analysis knowledge, you will most likely find Fibonacci retracements are useful if you decide to create a Forex trading strategy with Fibonacci retracement.

Fibonacci retracements are more difficult to trade than they look however. In addition, the levels are best exploited as a tool within a broader strategy, that looks for the confluence of a number of FX indicators, in order to pinpoint potential reversal areas, offering you low risk and high potential reward trade entries. Remember to implement risk management into your trading strategy, to minimise the risks associated with trading.