Forex and Contracts-For-Difference (CFD) trading uses leverage, which can greatly multiply your profit or loss. The larger the potential profit, the greater the risk. In fact, before starting to trade Forex and CFD, you need to understand that risk acceptance is a prerequisite for leveraged trading.

Yes there are many Forex trading risks, but there are also various ways to reduce them. We will lead you through the basics of how to minimize your losses using Forex risk management strategies. However, please remember that our aim here is to share knowledge, not advise actions.

read this guide to learn more about Forex trade and risk management.

Open a free, easy-to-use demo account so you can learn by doing without any risk.

Read our FAQs, before you start trading with a real account.

Your profit opportunities are always connected to comparable risks. Forex risk management can be seen as a brief-case containing numerous instruments, which you can use to help keep your trading losses low and potential gain high.

Forex trading risk management is based on four important principles, including::

Assessing the market is a primary focal point for new and seasoned traders. Yes the right market position is important – but experienced traders consider risk management equally important.

One of the main reasons for choosing to trade Forex and CFD is access to leverage. Why? Because leverage offers a reduced margin requirement when compared to a full investment - you put in less to potentially gain more. But remember, if the market does not react your way, you can also lose more too.

VipTrade offers Forex trading leverage of up to 1:25 or 1:200. For example at a leverage of 100-to-one, you can move 10,000 USD with a margin of just 100 USD.

The higher the leverage, the faster you gain profit or loss. If you lose, it may be because of over leveraging - meaning you chose a leverage level with a risk too high for you to manage. While trading with smaller investments is an attractive option for avoiding over-leveraging, it also reduces your potential profit. So, always carefully select your leverage according to your account volume.

Learn trading without taking risks with VipTrade demo account

OPEN DEMO ACCOUNTForex and CFD trading is subject to consistent market movements and every order starts slightly in the negative because the spread (the difference between bid and ask price) gets deducted on order opening. With these points in mind, it"s little wonder that your market assessment won"t always be right and you will sometimes lose profit. But how much you lose, can be controlled by setting a stop loss mechanism at the final level you are prepared to accept loss. However, bear in mind that setting stop losses too narrowly, might lead to your order being closed on a minimal market movement.

Remember, not every trade will conclude in a profit.

The market is constantly influenced by news, opinions, trends and political decisions in milliseconds. Two examples from the many options, are:

Even if you are actively paying attention to the market, it is not humanly possible to know every change before it happens. Our point? Set up automated stop mechanisms like the stop loss, to close your trading order for you. But remember, the stop loss cannot help you completely avoid loss - just indicate when action can be taken to reduce it.

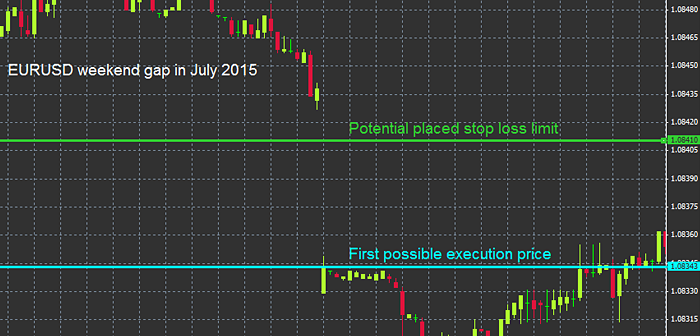

These are significant leaps in price, that are shown on a trade chart. Market gaps usually occur when the markets are closed, but even open markets can react to unexpected economic news that causes trading orders to close far from the desired threshold. So why is this important? Because even automated mechanisms like the stop loss, can only close orders at the next available quote after the jump. The EUR/USD chart example, shows:

In Forex trading terms, the illustrated gap in this chart represents negative slippage. But of course, a gap this size can also work in the opposite direction causing positive slippage – where you get more profit than your desired take profit would have produced.

Quotes can move rapidly, especially when the market is volatile or nervous. A smartly placed stop loss usually reacts much faster than a human trader could, making it one of your most important Forex risk management tools. With our MT5 account, you can create a specific stop loss when opening an order or a general stop loss for all open orders.

Choosing the right stop loss is discussed in countless articles and reports, but there is no "golden rule" for all traders or trades. For each trade, you need to choose the appropriate stop loss limit, by answering several questions.

>What is the trade"s time frame (remember - the longer a trade is open, the more volatile it will probably be)?

>What is the target price and when do I expect to reach it?

>What is my account size and current balance?

>Do I have any open positions?

>Does my order size match my account size, account balance, time frame and current market situation?

>What is the general market sentiment (e.g. volatile, nervous, awaiting news or other external factors)?

>How long will this market stay open (e.g. is the weekend coming soon or is the market closed overnight)?

As there is no general rule for the stop loss limit, we suggest using our free demo account to learn by doing without taking risks. Here you canpractice a few example trades and test various stop limits in different scenarios. If you have a live account, you can also use MT5 extensions like our trade terminal function, which displays the indicative risk for stop losses in your account"s currency.

Practice example trades and test various stop limits in different scenarios with our free demo account. Learn trading without taking risks.

OPEN DEMO ACCOUNTEven the best traders do not achieve profitable trades every time. In fact, a good quota of Forex trades ranges between 5 to 8 profitable trades out of 10. So it"s clearly important to calculate your order sizes with enough trade capital available to outlast market movements.

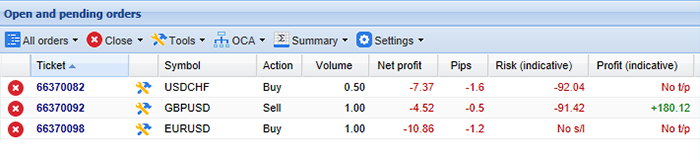

As you know, choosing leverage that is too high (over leveraging) will increase your risk and a few negative trades can ruin your overall trading result. With VipTrade, you can:

Remember to consider external factors in your Forex risk management strategies. There are numerous examples of factors that can influence trading quotes, such as:

Try our trade calculator to experiment with trading scenarios.

TRY TRADE CALCULATORYou may already know that VipTrade has been delivering easy, professional access to financial traders for years. But did you know we also provide exclusive safeguards and service packages free of charge?

A margin call is an automated trigger to notify you of when your account reaches a low margin level, which can help you make timely decisions about whether to close a trade.

Your account balance in MetaTrader 5 will be highlighted in red when your account reaches a margin level of 100%.

A stop out is an automated trigger to close a trade which can help protect you from greater losses in open markets by:

Stop outs do not protect against slippage as they are not immediate, and are only triggers to close a position at the nearest available price. The price at which the stop out is realised may be different from the price at which the stop out is triggered.

When a stop out is activated, open contracts (or trades) are closed one by one, starting with the trade with the biggest loss. Once the trade is closed, the margin on your account will be recalculated based on any remaining open trades. If your account hits its stop out level again, the next open trade carrying the biggest loss will be closed.

The Swiss central bank unexpectedly decoupled Switzerland from the Euro on January 15, 2015. Panicked trades ensued, causing an enormous surplus on one side of the market. This led to a severe lack of liquidity, making trades near impossible through significant market peaks. As there was virtually no liquidity for a while, stop losses experienced large delays that were far off their intended target values. This led to significant rejections and losses as well as considerably negative account balances for countless traders.

This kind of extremely rare event is known as a Black Swan. So what, you may ask? At VipTrade we are big on providing clear, open information that helps you prepare successful Forex trading risk strategies and in the case of a Black Swan - we are letting you know that there"s no chance to prepare! In the Swiss central bank case, two things where made clear:

All joking aside, Black Swan events can not be planned for or calculated. So as a general rule for successful Forex and CFD leveraged trading - never trade money you can not afford to lose in the worst case scenario.

Part of helping avoid many of the Forex trading risks we have discussed in future, involves learning from past trades. So taking the time to analyse your trading history and keeping a trade journal, are sensible measures.

Analyzing your past Forex trades will almost always provide useful insights into risks and your personal weaknesses. For example, you may learn that you:

The learning possibilities are endless, but the point is constant - analyzing your past trades can positively influence future ones. Knowing your strengths and weaknesses is essential to successful trading.

Advanced MT5 Supreme Edition analysis features such as the connect extension and the trade analysis section, can help your analysis via extensive trade information and account balance adjustments after every completed trade.

Learn trading without taking risks with VipTrade demo account

OPEN DEMO ACCOUNTThe Forex and CFD trading market offers exciting profit opportunities via daily long and short orders. But remember, it can also deliver big losses if you do not practice effective trade and risk management. Identifying your weakest links and managing them correctly can help limit your losses, because as you now know - you may win 8 of 10 times, but one loss can instantly remove those gains.

We know that the psychological factors around initial trade failure can be disheartening for beginners, but it is important to understand that loss is part of the overall trading experience. Before making your first live trade, understand:

This article serves as a trader"s risk management overview, by offering explanations together with useful countermeasures for general Forex and CFD trading risks. However, VipTrade does not provide investment consultancy so please:

But hey, don"t forget that Forex and CFD trading is not all doom and gloom either! Selecting suitable risk management measures and consistently exercising them, can significantly improve your profit/loss ratio for successful trading.