or choose a category to quickly find the help you need

At VipTrade, client data protection is a priority and we follow best practices which are described in details in our Privacy Policy. There are also actions we strongly suggest you take to help keep your personal data safe:

For more information about online security as well as actions that VipTrade takes to protect your data, please review our safety page: https://viptrade.eu/en/company/regulated-sceured Please contact us immediately via our official communication channels should you have any concerns or receive any suspicious contact, we are always here to support you.

LLC TRADE HOLDING P/N (416331507) was registered on 29 December 2016 and received its National Bank of Georgia licence on 17 April 2018.

VipTrade is a No Dealing Desk Execution* broker, offering professional trading conditions, superior execution technology and access to deep liquidity.

Trade CFDs on a wide range of instruments, including popular FX pairs, Futures, Indices, Metals, Energies and Shares, and experience the global markets at your fingertips.

VipTrade also offers free educational material, forex trading tools and demo trading accounts to all of our clients to help them practice and learn more about CFDs trading before opening a live trading account. VipTrade customer support team is ready to help you 24/5 with any queries you may have in more than 6 languages.

We have main offices in Georgia and Khazakhstan. These are separate legal entities belonging to the same group and each jurisdiction is regulated by the relevant regulatory body in that country.

Find more information regarding our partnership options via this link:

Fill in our online form with your contact details and some basic information (e.g. your website (if applicable), number of potential clients, etc) and one of our representatives will contact you to discuss this further.

Find more information regarding our partnership options via this link: https://viptrade.eu/en/tarde/ib

Commissions are credited to your VipTrade Wallet on a weekly basis. You may use bank wire transfer to withdraw your commissions.

To register for a live trading account, click on the 'Register' icon on the VipTrade homepage and follow the steps required to complete the sign-up process. You will automatically receive an email with your platform credentials to the email address you have provided. Login to VipTrade Cabinet with your email address and selected password. From there, you can upload your documents (if you haven't yet), manage your account, download our platforms and fund your account.

Please note that the jurisdictions available to you will depend on your country of residence. VipTrade does not offer Contracts for Difference(CFDs) to residents of certain countries such as the United States of America and the Islamic Republic of Iran.

You can open a trading account on your company name via our usual sign-up procedure. Please enter the personal details of the person who will be the authorised representative and then log into VipTrade Cabinet to upload official company documentation such as a certificate of incorporation, articles of association etc. Once we receive all necessary documents, our Back Office Department will review them and assist in the completion of the application.

VipTrade offers swap-free accounts for religious purposes. However, fees may be applied once trades on certain instruments are open for a specific number of days. To apply for a swap-free account, please send an email request to our Back Office Department at [email protected]. For further details on VipTrade swap-free accounts, please contact our Customer Support.

Yes. To open a joint account, each person must first open an individual VipTrade account and then fill a Joint Account Request Form which can be obtained by contacting our Back Office Department at [email protected].

Please note that joint accounts are only available to married couples or first degree relatives.

Yes, VipTrade allows up to 5 different trading accounts. You may open additional trading accounts via your VipTrade Cabinet.

Clients of LLC TRADE HOLDING may open a trading account in USD, EUR, GBP.

It is recommended that you select a Wallet currency in the same currency of your deposits and withdrawals in order to avoid any conversion fees, however you can select different base currencies for your Trading Accounts. When transferring between Wallet and an account in a different currency, a live conversion rate will be displayed to you.

We offer a variety of account types for you to choose from:

MT5 account with floating spreads and Market Execution.

can see a useful comparison table of the account types and features on the page below: https://viptrade.eu/en/platforms.

Yes. Demo accounts are a valuable trading tool to help beginners learn how to trade and allow experienced traders to experiment and test new strategies in a risk-free environment.

You can open demo accounts via VipTrade Cabinet.

Although demo accounts present real market conditions and prices, please keep in mind that they are simulations and cannot always reasonably reflect all of the market conditions as during highly volatile or illiquid periods (e.g. market openings, news announcements) they may not behave in the same manner as live accounts.

You may open as many demo accounts as you wish. Demo accounts can be recharged with funds via VipTrade Cabinet. However, please note that demo accounts will be deactivated after 180 days. Also, our MT5 demo accounts are limited to a maximum of 70 open positions.

Although demo accounts present real market conditions and prices, please keep in mind that they are simulations and cannot always reasonably reflect all of the market conditions as during highly volatile or illiquid periods (e.g. market openings, news announcements) they may not behave in the same manner as live accounts.

Margin and leverage settings may vary between your demo and live account and you should not expect any success with the Demo Account to be replicated in your live trading.

For this reason, it is strongly recommended that demo accounts are viewed solely as a learning tool for inexperienced traders or a place for testing new trading strategies.

You will be able to fund your account once it gets verified to start trading with VipTrade.

VipTrade takes serious precautionary measures to ensure that your personal details are held in absolute confidence. Your passwords are encrypted and your personal details are stored on secure servers and cannot be accessed by anyone, with the exception of a very small number of authorised members of staff.

We require a copy of your valid International Passport, National ID card or Driver's Licence in order to verify your identity.

We may also request a Proof of residence document showing your name and address, issued within the last 6 months.

The document(s) required and their current verification status can be seen at any time via VipTrade Cabinet.

You can upload your documents at the time of your registration. You can also upload documents via your VipTrade Cabinet by clicking on 'My Profile' and then 'Upload documents'.

Document verification is usually very fast and you can always check the status from the same section in VipTrade Cabinet.

Please note that uploading the documents through Cabinet is the only acceptable channel of submitting these documents and that any documents sent by email will not be processed.

As a regulated broker, we are required to assess the suitability of our clients in regards to their understanding of CFDs and knowledge of the risks involved.

If it is deemed that you do not currently have the experience required, you can proceed with a demo account creation, and read through our Education Section in order to familiarise yourself with the market and practice trading. Once you feel that you are ready and experienced enough to open a live account, and are fully aware of the risks involved, please contact us so we can reassess your suitability.

If the information you provided to us on the registration form was inaccurate, please let us know so we can contact you to clarify any errors.

The MT5 trading platforms is compatible with Mac and can be downloaded from our https://viptrade.eu/en/platforms/mac-os. Please note that the web-based and mobile versions of our https://viptrade.eu/en/platforms/iosplatforms are also available.

Yes. Expert Advisors are fully compatible with our MT5 platforms. Automate can be used.If you have any questions regarding Expert Advisors, please contact our Customer Support at :[email protected].

This may be because you have placed your stop-loss or take-profit levels too close to the current price. Alternatively, it may mean that you have set these levels on the wrong side of the current price.

Please note that for short positions (sell orders) stop-losses must be set higher than the current market price and take-profit levels must be set lower than the current market price.

You can view the minimum stop levels for each platform in the symbol's specifications: https://viptrade.eu/en/tarde/product-leverage/forex

Open MT5, go to File>Open Data Folder, then select MQL5>'Experts' or 'Indicators' and paste your MQL5/EX5 file in this folder.

When you reopen the platform you should now see your custom EA/Indicator in the Navigator window. You can drag and drop it to the chart(s) of your choice.

You can find custom EAs and Indicators on the MQL5 website: https://www.mql5.com/en/code/mt4

To make sure that your EA is running correctly you must first confirm that EAs are enabled on your platform. To do so, check that the ‘AutoTrading’ button on the main toolbar at the top of the screen is green. In case it is red, click on it to enable EAs.

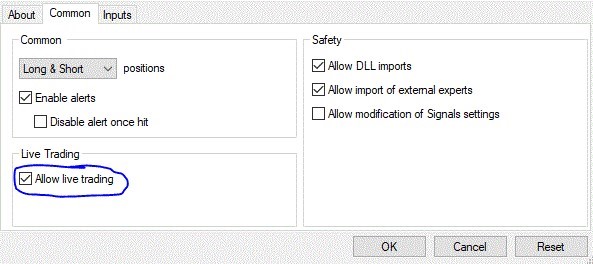

You must then ensure that your EA is enabled for live trading. To do this, right-click on the chart where the EA has been placed, select ‘Expert Advisors’ and then ‘Properties’. Check the box labelled ‘Allow live trading’ and click ‘OK’. Your EA should now be working properly.

Once your EA is up and running, you can check the ‘Experts’ and ‘Journal’ tabs in your terminal to see if your system is reporting any errors.

Please note that if your EA is running and automatic trading is enabled, you will be able to see a smiley face on the top right corner of the chart next to the name of the EA.

It seems you don’t have Expert Advisors enabled on your MT5 terminal. This can be done by simply clicking on the ‘AutoTrading’ button in the main toolbar above the chart. When the little symbol inside it turns from red to green, EAs have been enabled. Alternatively you can do this by going to ‘Tools’, ‘Options’, select the ‘Expert Advisors’ tab and ensure that the ‘Enable Expert Advisors’ box is ticked. Please also ensure that the specific EA is enabled for trading by selecting 'Allow Live Trading' in the 'Common' tab when you drag the EA to the chart

To remove an EA from your MT5 platform, right-click on the chart, select ‘Expert Advisors’ and then ‘Remove’.

All account information and trade history is found in the ‘Terminal’ window at the bottom of your MT5 screen. At the bottom of this window you will find the following tabs:

To manually add the instruments you wish to see in the list, right click in the Market Watch window and select 'Symbols'. You may also create custom sets.

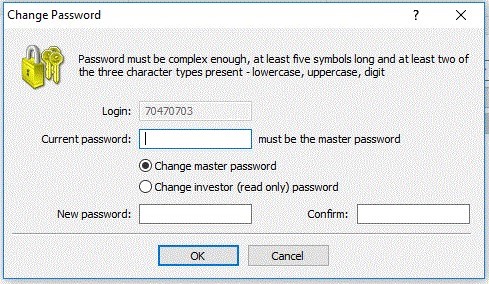

An investor password enables the user to view trading activity but with no access to open/close or modify any trades. It is essentially a 'read only' access.

Once logged in the platform with your master password, please go to Tools>Options and under the 'Server' tab, select 'Change Password'. Then, select 'Change Investor (read only) password'

The History Center provides you with access to historical chart data on the MT5 platform. Please go to Tools>History Center or select the F2.

The amount of historical data available depends on the timeframe you choose due to the fact that there is a maximum number of bars data available for each timeframe (approx 2050 records).For instance if you choose a small timeframe (eg 1M) you may only receive data for one or two days.

You may download additional data, however this is taken from the MetaQuotes server.

Contracts for Difference (CFDs) are derivative instruments that allow traders to speculate on the changing values of underlying assets without having to take ownership of them. In a contract for difference, a buyer and a seller agree that the seller will, upon expiration of the contract, pay the buyer the difference between the value of the asset at the time of the contract agreement and the contract expiration. If the difference is negative then the buyer must pay the difference to the seller. When trading CFDs traders buy (go long) when they are expecting a rise, and sell (go short) when expecting a drop in value.

Forex Currencies are traded in pairs. Each currency is presented as a three letter abbreviation and is usually separated from the currency it is paired with a space, a point, or a slash. For instance, EUR/USD refers to the Euro US Dollar currency pair. The first currency in the pair is known as the base currency. The second currency in the pair is known as the quote or term currency. The value of the pair is defined by how much of the quote currency is required to purchase a single unit of the base currency. So if EUR/USD is currently trading at 1.31 then this means that $1.31 is required to purchase €1.

We offer competitive floating spreads on all of our platforms. On MT5 accounts, you are only charged the spread on any instrument and commission. For detailed information regarding the spreads, please check the specifications for the specific instrument: https://viptrade.eu/en/tarde/price-commission

If your pending order has not been executed, it may be because you did not have sufficient funds to open the position when the pending order was triggered. If this is the case, the deleted pending order will appear in your account history.Alternatively, your pending order may not have been executed because the specified price was not reached. Please note that for pending Sell Orders, the bid price must reach your specified level; for pending Buy Orders, the ask price must reach your specified level.

On /MT5 & Spread betting accounts we do not charge any commission on any instruments. You are only charged the spread, on which we apply a small mark-up (and any applicable swap charges).

At VipTrade we offer CFDs on Forex, Metals, Futures, Shares, Spot Indices, Spot Energies & Cryptos. Please visit our page to find out more information about each asset: https://viptrade.eu/en

With Instant execution your order will be executed at the requested price or you will receive a requote.

With Market execution your order will be executed at the available market price at the time, at VWAP (Volume Weighted Average Price)

We offer MT5 accounts with Market execution, and MT5 Fixed Spread accounts with Instant execution.

You can find more information about order execution on our website: https://viptrade.eu/platforms

Please note that for pending orders the execution is the same regardless of account type (i.e. all stop orders are executed with 'market execution' and all limit orders are executed with 'limit execution').

A stop-loss order may serve as an additional risk minimisation strategy. However, the requested price of a stop-loss order is never guaranteed. This is because the price at which the stop-loss order is placed serves only as a ‘trigger point’. In the event that the price of the financial instrument being traded reaches the trigger price, your stop-loss order will be treated as a market order and executed at a Volume Weighted Average Price (‘VWAP’) as per the Order Execution Policy. As a result, a stop-loss order may be executed at a worse price. This applies to all 'stop' orders placed on any of our platforms.

We quote all FX pairs to an extra digit, meaning that the last digit is the 'point' and the second to last digit is the 'pip'.

We are an NDD execution broker offering CFDs on 6 underlying assets. We offer Market Execution on most of our account types but we however also offer an Instant Execution account.

We internally match a great deal of our order flow and residual exposure remains in house up to our market risk limit. Excess exposure may then be hedged externally.

You can read more about our execution model on the page below:

Slippage is part of trading and common in the forex market. It occurs at times of high volatility or low liquidity, as well as during major news announcements or during the release of important economic data.

VipTrade takes all necessary steps to protect traders against market volatility, and our clients benefit from a highly-advanced trade management system that mitigates the risk of negative slippage and guarantees execution at the best available price.

You can check out our excellent slippage statistics here:

Yes, micro lots are available on all our platforms with our Micro account type.

The leverage available to you may differ depending upon your jurisdiction and the instrument/platform you are trading with.

Please follow the link below to find out more information in regards to leverage:

Fixed spreads do not vary throughout the day as floating spreads do. There is a day rate, a night rate, a night rate for fixed spreads and an abnormal rate that appears only during extremely volatile market conditions.

A fixed spread account allows you to manage your trading costs more effectively, as you can know in advance the pip difference between the bid and the ask prices.

To see the Instruments we offer Fixed Spreads on, please refer to the Forex page below and tick the box ‘Show pairs with fixed spread’:

Floating spreads vary throughout the day, depending on market volatility and available liquidity. They represent the best bid and ask prices we are able to secure from our liquidity providers.

The greatest advantage of floating spreads is that you receive the best current market price at the time you are trading, which can often be lower than when trading on a fixed spread account. On the other hand, floating spreads can also widen considerably before and after high-impact news announcements and during high market volatility.

MT5 platforms use Market Execution and there are thus no requotes.

However, you may experience requotes on the MT5 Instant accounts during highly volatile market conditions. You may avoid requotes by checking the ‘Standard Deviation’ box at the bottom of the ‘Order’ window, which will allow you to set the pip range that will be available to you if the market price deviates from the price you clicked.

Please note that the pop-up window for requotes is disabled when using the one-click trading feature. You will, however, hear a sound alert when a requote is given, provided that sound alert is enabled (Tools > Options > Events), and the requote will be stated in your log files within the client terminal.

Margin level (%) is displayed on the trading platform and is calculated as follows: Equity / Margin X 100.

VipTrade offers Negative Balance Protection (subject to the VipTrade Order Execution Policy) to ensure that clients cannot lose more than their overall investment.

For Micro Types registered accounts, the stop out level is 50% for all accounts.

For Pro Types registered accounts, the stop out level is 40% for all accounts.

For VIP Types registered accounts, the stop out level is 30% for all accounts.

Limit and stop orders are often confused with each other as both are pending orders that instruct a broker to open or close a position when an asset’s price reaches a certain level.

Buy limit orders instruct that a position is opened when the market price reaches a level lower than the current price. Sell limit orders instruct that a position is opened when the market price reaches a level that is higher than the current market price. Conversely, buy stop orders are entered above the current market price and sell stops are entered below the current price.

Bear in mind that pending Limit orders are executed with ‘Limit Execution’, meaning you will receive your requested price or better, whereas Stop orders are executed with ‘Market Execution’, meaning that the trade is executed at VWAP.

In order for your EAs to trade for you, your machine must be running with your MT5 terminal open. Closing your terminal will cause your EAs/cBots to stop trading. You can subscribe to VipTrade VPS (Virtual Private Server) to have your EAs/cBots trade around the clock regardless of whether your MT5 terminal is open or your computer running.

Swap is calculated by taking the difference between the respective interest rates in the currency pair being traded and adding VipTrade's commission fee for rolling over the position to the next trading day. The result can either be positive or negative depending on the instrument.

Swap is calculated from Monday to Friday at 22:00 UK time. The figure is calculated at triple rate on Friday to account for the weekends, when swap is still applied, even though banks and markets are closed.

Swap fee for FX= Pip value X swap value in points] / 10

Swap fee for Non-FX instruments= Lot size X Swap Value X Number of nights.

We have a useful Swap calculator you can use to estimate the Swap incurred on trades: https://viptrade.eu/en/tarde/price-commission

The recommended minimum initial amount is 1000 USD. However, you may fund as little as 250 USD each time.

VipTrade offers Negative Balance Protection (NBP) for all clients, regardless of their categorisation & jurisdiction, thereby ensuring that you cannot lose more than your total deposits.

For more details please refer to our ‘Order Execution Policy’.

VipTrade also provides a stop out level, which will cause trades to be closed when a certain margin level % is reached. The stop-out level will depend on the account type and jurisdiction under which you are registered.

We accept Bank Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill and some more methods available as per your country of residence.

All available payment methods and processing times under each jurisdiction can be seen via this link: https://viptrade.eu/en/tarde/deposit-withdrawal

Please note that you must withdraw via the same method used to fund your account.

VipTrade clients benefit from some of the most competitive exchange rates on the market.

For deposits from an external funding source (i.e., from your credit card to your VipTrade Wallet in another currency) and withdrawals to an external funding source ( i.e., from your VipTrade Wallet to a credit card in another currency), funds will be converted as per the daily bank rate.

For transfers from your VipTrade Wallet to a trading account of a different currency, and vice versa, conversion will be made as per the rate displayed on the pop-up screen at the time you click confirm.

For international bank wire deposits, please allow 3-5 business days for funds to reflect in your VipTrade Wallet. VipTrade does not charge for bank wire deposits but the sending and correspondent bank may charge according to their own fee structure.

GBP transfers between UK banks usually reflect within the same business day and there are no fees.

SEPA transfers usually reflect within the same business day and the fees are very low (usually a few euros).

After the cancellation of a card, banks are obliged to allow limited transaction types to take place, including refunds, usually for at least 6 months. You should therefore withdraw funds to the card you used to deposit, even if this card has been cancelled. You will receive these funds to your new card which is connected to the same bank account as your previous, cancelled card.

If the bank account linked to the card is completely closed, you will need to send proof of account closure to our accounting department at[email protected]

Yes, as long as the specific trading account you are transferring from does not have any open positions.

If you have an open trade during the weekend, you will be unable to transfer funds from it to your Wallet until the market reopens.

Weekend hours begin on Friday at market closure (22:00 UK time) until Sunday, at market opening (22:00 UK time).

Log in to your VipTrade Cabinet, select 'Withdraw Funds' or 'Wallet' and choose Bank Wire method. Bear in mind that we may require a bank statement as proof that you are the bank account holder.

Kindly be informed that in order to withdraw via Bank Wire method, you should first refund all your Credit Card, PayPal and Skrill deposits within the last 6 months.

Log in to VipTrade Cabinet, select 'Deposit', choose Bank Wire method and fill out the required information.

The relevant banking details will appear on the screen for you to use to make a transfer to us.

Withdrawal requests are processed by our Client Accounting Department within 1 working day. However, the time needed for the funds to be transferred will vary, depending on your payment method.

International Bank Wire withdrawals may take 3-5 working days.

SEPA and local bank transfers may take up to 2 working days.

Card withdrawals may take 5-7 working days

All other payment method withdrawals are usually received within 1 working day.

During normal working hours, withdrawals are usually processed within a few hours. If the withdrawal request is received outside working hours, it will be processed the next working day.

Bear in mind that once processed by us, the time taken for your withdrawal to reflect will depend on the payment method.

Card withdrawals can take around 5-7 working days and International Bank Transfers may take 3-5 business days depending on your bank. SEPA and local transfers usually reflect within the same business day, as do E-Wallets transfers.

Please note that although card deposits are processed immediately, this does not mean that funds have already been received in our bank account as the bank clearing procure usually takes some days. However, we credit your funds immediately in order to be able to trade instantly and protect open positions. Unlike deposits, the withdrawal procedure takes longer.

International Bank Transfer: 3-5 business days approximately, depending on your bank. SEPA and local transfers usually within the same business day. All other payment methods: 10 minutes approximately.

https://viptrade.eu/en/tarde/deposit-withdrawalto see more information on the processing times of each payment method.

You can select to send the deposit to your Wallet, or directly to a trading account of your choice.

Bear in mind that all transactions are placed via the Wallet, so currency conversions may apply when transferring directly to a Trading Account in a different currency to your wallet

It is our policy that any card deposits made within a 6 month period should be withdrawn to the card in question first, before refunding to any other method, even if other methods were used for funding. Kindly note that after refunding any cards, any PayPal deposits that were made within the last 6 months should be refunded via this method too and finally any Skrill deposits made within the last 6 months should also be refunded via Skrill. Once all deposits from the above-mentioned payment methods are fully refunded, you will then be able to withdraw via bank wire or another e-wallet method previously used to fund. (Provided that your e-wallet account can receive payments)

VipTrade does not charge any fees/commission on deposits/withdrawals, however, you may be subject to fees from banks involved in the case of bank transfers. Please note that for e-wallets, there may be a fee for withdrawals, if you have not traded. You can see more details on our funding page: https://viptrade.eu/en/tarde/deposit-withdrawal

Clients of VipTrade UK Limited may fund Wallet in: USD, EUR, GBP, AUD, CHF, JPY and PLN.

Clients of VipTrade Financial Services Limited may fund in: USD, EUR, GBP, AUD, CHF, JPY, PLNand ZAR. Fundung in RUB are also available, yet funds deposited in RUB will be converted to the currency of the client’s VipTrade Wallet (Vault) upon receipt.

Clients of VipTrade Global Markets Limited may fund in: USD, EUR, GBP, CHF, AUD, PLN, ZARand JPY. Funding in RUB are also available, yet funds deposited in RUB will be converted to the currency of the client’s VipTrade Wallet (Vault) upon receipt.

Please note that if you transfer funds in a different currency from your VipTrade Wallet, the funds will be converted into you Wallet currency using the exchange rate at the time of the transaction. For this reason, we suggest you to open your VipTrade Wallet in the same currency as your funding and withdrawals methods.

We accept Credit/Debit cards including Visa, Visa Electron, Visa Delta, American Express, MasterCard, Maestro International.

If you have made a withdrawal request via Bank Transfer and have not received your funds within 5 working days, please contact our Client Accounting Department at [email protected], and we will provide you with a Swift Copy. If you have made a withdrawal request via Credit/Debit Card and have not received your funds within 10 working days, please contact our Client Accounting Department at [email protected] and we will provide you with the ARN number.

There are a number of reasons why your Credit/Debit card may have been declined. You may have gone over your daily transaction limit or exceeded the card’s available credit/debit amount. Alternatively, you may have entered an incorrect digit for the card number, expiry date or CVV code. For this reason, please verify that these are correct. Also make sure that your card is valid and has not expired. Finally, check with your issuer to make sure that your card has been authorized for online transactions and that there are no protections in place that are preventing us from charging it. Find more information

VipTrade Cabinet is your online account management page.

Click on the 'Sign In' option on the top right of the website. You can log in with your registered email address and password. Your VipTrade Cabinet allows you to create new accounts, edit existing ones, fund your accounts and download trading platforms. You may also edit your mailing options or subscriptions.

To reset your VipTrade Cabinet password, click on ‘Restore password’ at the bottom of the sign-in box. Enter your registered email address and submit the request. You will soon receive a link at the email address you have provided, which will take you to a page where you will be able to enter a new password for your account

To upload documents via VipTrade Cabinet click on ‘My Documents’ and select ‘Upload Documents’. Click ‘Browse’ to open a new window, find and select the document that you wish to upload, and then click ‘Open’.

You will receive a notification that the upload is in progress, and a message confirming that the documents have been uploaded successfully.

Once your documents have been uploaded, our Back Office Department will review them in the order in which they were received.

To change any of your personal details, please send an email to [email protected]. Bear in mind that for security reasons, we will require an updated proof of residence to be uploaded via VipTrade Cabinet for a change in address and a phone verification for a change of email.

Please log into 'VipTrade Cabinet' and click on Accounts. Next to account number you will see the icon to 'Reset Password'. Once you click on it, system will automatically send email containing a new temporary password.

Please note that live accounts are disabled after 3 months of inactivity, but you may, however, reactivate them. Unfortunately, demo accounts cannot be reactivated, but you may open additional ones via VipTrade Cabinet.

In order to request reactivation, please send an email to [email protected]or contact us on Live Chat.

Log in to Viptrade Cabinet, go to ‘My Accounts’, click on the Pencil icon next to your account number and select ‘Change Leverage’ from the drop-down menu.

Please note that in order for the leverage of your trading account to be changed, all open positions must be closed.

Note: The maximum leverage available to you may vary depending upon your jurisdiction.

Log in to your VipTrade Cabinet, go to ‘My Accounts’, click on the demo account heading, and select 'Add Funds'. Please select the desired amount (500 – 500,000) and your demo account balance will be instantly updated on your trading platform.

Log into your VipTrade Cabinet, and you will see your transaction history under the 'Wallet' tab. There is also a filter and an option to 'Export' the transactions.

Website terms and conditions

Please find below a comprehensive list of the Terms and Conditions related to the use of our website(s). It is important that you make yourself aware of these and agree to them before using our website(s).

Please read these terms and conditions carefully before using this site

These terms outline the rules for using our website(s) www.viptrade.eu, including any language sites (collectively, ‘Our site’).

Who we are and how to contact us

Our site is owned and operated by VIPTRADE (‘we’, ‘us’, ‘ours’). LLC TRADE HOLDING Information regarding the aforementioned entities can be found on our Site.

For more information on how to contact us click https://viptrade.eu/en/company/contact-us.

By using our site you accept these terms

By using our site you confirm that you accept these terms of use and you agree to comply with them. If you do not agree with these terms you may not use our site and our services.

By continuing to use this site you consent to all the information provided to you in English language (including marketing and other material) unless you have chosen and/or accepted to receive information in more than one language.

Further, by continuing to use the site you consent that the information provided via the site is in a medium, considered as ‘durable medium’, and you agree that due to the nature of the services we offer (i.e. online services) information found online is considered as being in durable form.

There are other terms that may apply to you

The following terms of use also apply when using our site:

We may make changes to these terms

We may make changes to these terms

We may amend these terms from time to time. Every time you wish to use our site please check these terms to ensure you understand the terms that apply at that particular time.

We may make changes to our site

We may update and change our site from time to time. You can find the most up-to-date version of these terms on our site.

We may suspend or withdraw our site

Our site is made available free of charge.

We do not guarantee that our site (including any content and links) will always be available or uninterrupted. We may suspend, withdraw or restrict the availability of of our site or a part of it for business, operational or other reasons. We will try to give you reasonable notice of any suspension or withdrawal.

Any person accessing our site shall be made aware of these terms of use and other applicable terms and conditions.

OUR SITE IS NOT FOR USERS in certain countries including but not limited to the United States of America and Canada and is not intended for distribution or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. From time to time the site may be unavailable or partly unavailable to other countries not listed above. There may also be instances where the site may be available in countries which prohibit the use of this site. In this case, it is the responsibility of the visitor to ensure that the site complies with any local laws or regulations to which they may be subject to. We do not guarantee that the content available on our site is appropriate for use in the location and jurisdiction where this site is accessible.

You must keep your account details safe

If you choose or you are provided with a user identification code, password or any other piece of information as part of our security procedures you must treat such information as confidential. You must not disclose it to any third party.

We have the right to disable any user identification code or password whether chosen by you or allocated by us, at any time, if in our reasonable opinion you have failed to comply with any of the provisions of these terms of use.

If you know or suspect that anyone other than you knows your user identification code or password you must promptly notify us.

How you may use material on our site

We are the owner or the licensee of all intellectual property rights on our site as well as the material published on it including any copyright, database rights and trade marks. Any such right not belonging to us belongs to third parties whom we have obtained their approval for use and are protected by copyright laws and treaties around the world. All such rights are reserved.

Our site contains both public and client areas. The client area is only accessible to clients who have opened an account with us and have been given access to our trading and other platforms.

You must not modify the paper or digital copies of any materials you have printed off or downloaded in any way and you must not use any information or material found on the site in any way. Material on our site is intellectual property belonging to us and you have no right on any such material.

You must not use any part of the content on our site for commercial or any other purpose without obtaining a licence from us or our licensors.

If you print off, copy or download any part of our site in breach of these terms of use we may take the respective action as we deem appropriate.

Do not rely on information on this site

The content on our site is provided for general information only. It is not intended for advice on which you should rely on. Please obtain professional or specialist advice before taking or refraining from any action on the basis of the content on our site.

Although we make reasonable efforts to update the information on our site we do not guarantee that the content on our site is accurate, complete or up to date.

Rules about linking to our site

You must not establish a link in such a way as to suggest any form of association, approval or endorsement on our part where none exists.

You must not establish a link to our site in any website.

Our site must not be framed on any other site, nor may you create a link to any part of our site.

You must not use our domain name or part of it for any use which is not authorised by VIPTRADE.

If you wish to link to or make any use of content on our site other than that set out above, please contact us.

Our responsibility for loss or damage suffered by you

We do not exclude or limit in any way our liability to you where it would be unlawful to do so in our jurisdiction. This includes liability for death or personal injury caused by our negligence or the negligence of our employees, agents or subcontractors.

Different limitations and exclusions of liability will apply to liability arising as a result of the supply of any products to you as set out in our Client Agreement.

To the maximum extent permitted by law, we will not be liable in any way for any loss or damage suffered by you through the use or access to our site or our failure to provide this site.

We exclude all implied conditions, warranties, representations or other terms that may apply to our site or any content on it.

We will not be liable to you for any loss or damage, whether in contract, tort (including negligence), breach of statutory duty, or otherwise, even if foreseeable arising under or in connection with the:

We are not responsible for viruses and you must not infect our site

We do not guarantee that our site will be secure or free from bugs or viruses nor that our site is fit for a purpose.

You are responsible for configuring your information technology, computer programmes and platform to access our site. You should use your own virus protection software.

You must not misuse our site by knowingly introducing viruses, trojans, worms, logic bombs or other material that is malicious or technologically harmful. You must not attempt to gain unauthorised access to our site, the server on which our site is stored or any server, computer or database connected to our site. You must not attack our site via a denial-of-service attack or a distributed denial-of service attack. By breaching this provision, you may commit a criminal offence under applicable legislation. We will report any such breach to the relevant law enforcement authorities and we will co-operate with those authorities by disclosing your identity to them. In the event of such a breach, your right to use our site will cease immediately.

Which country’s laws apply to any disputes?

The governing law and jurisdiction of these terms is set out in the ‘Client Agreement’.

Our trade marks are registered

All copyright, database rights, trade marks and any other intellectual property rights in the content of this site belong to us or a third party including our licensors. The content on our website (in whichever form) may or may not be identified by a symbol. The lack of any such symbol should not be understood as meaning that the name, term or data is not the intellectual property of either ourselves or any third party.

VIPTRADE (in word and stylised forms) have been registered locally as well as internationally. You are not permitted to use them without our approval.

We also have rights in our domain name and you shall not create or use any domain name, which contains the same words or identically similar words to our domain name and specifically, you should not use any words which include the word ‘VIPTRADE’ either alone or with other letters or words.

Additionally, all content on our site is copyrighted. No information or content on this site may be reproduced, adapted, uploaded to a third party, linked, distributed or transmitted in any form or manner.

Amendments

While we have made best efforts to ensure the accuracy of the information on this site the information given on the site is subject to change without any notice. We reserve the right to modify these terms at any time by publishing revised terms of this information. We will not notify anyone and the applicable version will be the most up-to-date one.

Severability

If all or part of a provision of these terms is deemed void, unenforceable or illegal by a court of competent jurisdiction then the remainder of the terms and conditions will have full force and effect and the validity or enforceability of that provision in any other jurisdiction shall not be affected.

Foreign exchange, also known as Forex or FX, is the market in which currencies are traded. The Forex market is the largest, most liquid financial market in the world, open 24 hours a day, five days a week. To put it into perspective, the New York Stock Exchange handles approximately $169 billion worth of transactions a day, while the Forex Market sees over a colossal $5 trillion worth of transactions a day.

Forex is traded in currency pairs. Common currency pairs are the Euro/US Dollar, US Dollar/Japanese Yen, Great British Pound/US Dollar, and Canadian Dollar/US Dollar. You buy one currency and automatically sell another. The goal is to make a profit by buying and selling currencies as their value increases and decreases. There are many economic factors that contribute to currency movements which traders and dedicated analysts alike attempt to decipher.

The Forex market is open 24 hours a day, 5 days a week and currencies are traded worldwide among major financial centres. It opens on Sunday at 10:00 pm GMT, and closes on Friday at 10:00 pm GMT:

Sydney is open from 10:00 pm to 7:00 am GMT

Tokyo is open from 12:00 am to 9:00 am GMT

London is open from 8:00 am to 5:00 pm GMT

New York is open from 1:00 pm to 10:00 pm GMT

It depends on the leverage used and the amount of capital invested. You could invest a starting capital of $50, or $50 000, the sky is the limit. However, it is important to remember that increasing leverage, increases risk; ultimately it depends on a trader's tolerance to and management of risk. Skilled traders are able to minimise risk and maximise profit thorough analysis, a trading strategy that suits their style and wise money management.

Unlike the stock market, the Forex market is not tied to a central exchange. Transactions are conducted between two counterparts over the telephone or via an electronic network, therefore the Forex market is considered an Over-the-Counter (OTC) or 'Interbank' market.

The primary participants in the Forex market - who make the spreads - are the largest banks in the world; Such banks include central Banks, commercial banks, and investment banks. Known as the interbank market as they constantly deal with each other on behalf of themselves or their customers. However, the percentage of other market participants is rapidly growing and now the list includes large multinational corporations, global money managers, registered dealers, international money brokers, futures and options traders and individual investors.

There are many factors that can and do contribute to currency prices. Such factors include economic and political events and announcements, interest rates, inflation, natural disasters and the list goes on. There is even debate over a mass psychology of how traders perceive the market at a certain point in time, which could contribute to how many base their trading decisions and thus influence the market. While there is absolutely no Holy Grail and sure way to predict price movements, there are some very thorough techniques implemented by analysts in an attempt to forecast potential price movements.

You only need a computer with internet connection and a free demo account or a funded live account with VipTrade to start. However, you should be equipped with proper Forex education and tools to minimize risks in the Forex market.

Reading through this FAQ is a great start! Be sure to check out the other educational content we offer such as – training programs, seminars, webinars and video tutorials. Creating a demo account is definitely your first step toward successful trading, novice and expert traders alike make use of demo accounts to get a feel for the platform, test and perfect trading strategies and configure various add-ons, plugins, scripts and indicators. More importantly, you will see the market as it exists in a live account and nothing beats a hands-on approach while you do your research. Demo accounts are both free of charge and risk. For more information simply contact your account manager. If you do not yet have an account manager open a demo account and one will be in touch soon.

Essentially you will want the market to move in your favour. You can move the odds in your favour by analysing the market in various ways. Technical analysis involves trends, historical data and current market movements. It takes a more statistical approach to trading by thoroughly examining the charts and indicators. Alternatively you have fundamental analysis which focuses more on important economic events and announcements which are likely to influence the market. In either case you should attempt to capitalise on potential market movements with a formulated trading strategy, wise decision making and clever money management. The sum of your profit depends on the efficiency of your trading strategy, on how well you learn to predict the alteration in rates and their tendencies and on the amount of your deposit which allows you to sustain unfavourable situations during market movements as well as capitalise on good trading opportunities.

The spread is the difference between the bid and the ask price. The bid price is the rate at which you can sell a currency pair, and the ask price is the rate at which you can buy a currency pair. With us, you can trade a large range of instruments with flexible spreads. That gives you a greater degree of price transparency on your trades.

The rollover rate, also referred to as “swap" or “interest" rate, is simply the cost-of-carry that is applied to your account on a day-to-day basis. It is the difference between the interest rates of the two currencies which a trader either earns or pays when a position is kept open overnight.

The term “order volume" refers to the number of standard lots you want to trade.

1.00 refers to 1 standard lot or 100,000 units of the base currency.

0.10 refers to 1 mini lot or 10,000 units of the base currency.

0.01 refers to 1 micro lot or 1,000 units of the base currency.

Spot markets refer to the markets that deal with the current price of financial instruments.Prices are settled on the spot at current market prices as appose to forward prices.

Essentially it's just trader's lingo for a buy or a sell order. If you are buying a currency pair, you are opening a 'long' position, and vice versa, a 'short' position while selling. For example, if you buy 1 lot of EUR/USD, it means you open a long position for 100,000 units of EUR against USD. If you sell 1 lot of EUR/USD that means you open a short position for 100,000 units of EUR vs USD. Think of it like this, when buying you want the value of the euro to increase (long) against the dollar and when selling you want the value to decrease (short) against the dollar.

Slippage occurs when the market gaps over prices or because available liquidity at a given price has been exhausted. Market gaps normally occur during fast-moving markets when a price can jump several pips without trading at prices in between. Similarly, each price has a certain amount of available liquidity. For instance, if the price is 50 and there is 1 million available at 50, then a 3 million order will get slipped, since 3 million is more than the 1 million available at the price of 50.

Margin is a percentage amount of the total trade size which a broker requires as a good faith deposit in order to allow a trader to open a position. This amount is not a fee or a transaction cost; it is simply a portion of your account equity set aside within your account as a deposit towards the trade. Margin requirements are calculated by taking a percentage of the notional trade size as determined by the broker in advance and specified in the trading conditions. For example, when you want to open 1 lot of USD/GBP (or 100,000 units of USD) using the leverage of 1:500, you will only need 200 USD as a margin (100,000/500). If you have less than 200 USD set aside you will be unable to meet the margin requirement, if you have 200 or more the order will attempt to execute.

A Margin Call is an alert when the account equity falls below the required Margin Level. This means, the account only has the supplied margin left and should be funded with more money in order to prevent it from facing a Stop Out or forced closure.

A Forex broker is an intermediary between you and the interbank market - networks of banks that trade with each other. Typically, a Forex broker will offer you a price from the banks that act as their liquidity provider. VipTrade uses multiple banks for pricing and we offer you the best price quotes with fast execution.

Trading on interbank is possible for private individuals, however it requires significant investment. So, unless a trader has at least $50,000.00 to $100,000.00 on hand, a financial leverage is also required. Forex brokers such as VipTrade provides that very leverage.

VipTrade also offers exceptional educational material regarding Forex trading, as well as tools to equip and assist traders in making wise trading decisions. We also offer webinars, live-trading sessions, daily Forex analysis, trade alerts, and one-on-one consultation with our resident experts.

Yes, we conduct regular trainings and seminars for free. Our sales team also does one-to-one consultation with clients for their specific trading needs, however VipTrade is restricted from providing actual financial advice.

To withdraw funds from the Live Account service, there is 3-tier system of protection.

To change the leverage specified in your Personal Cabinet, you have to contact our [email protected]

To change the trade account password in your Personal Cabinet, you have to contact our [email protected].

Go to "Profile" section of your Personal Cabinet and click " https://cabinet.viptrade.eu/change-password".To change the password, you will have to enter a new password and confirm it.

Contact our https://cabinet.viptrade.eu/treatment if you haven’t received an email with the confirmation code or don’t have access to the specified e-mail address.

Yes. it is. To register a Personal Cabinet for a legal entity, you have to:

The list of the documents required from a legal entity:

Please note that this is not an exhaustive list.

In case Personal Cabinet is registered to a natural person and the account attached to this Live Account was earlier deposited by the natural person, this account can not acquire "Corporate account" status. Please, register a new Personal Cabinet to a legal entity and send a request from it.

In the case when the direct/immediate and principal shareholder is another legal entity, the Company need to verify the ownership structure and the identity of the natural persons, who are the beneficial owners and/or control the other legal entity on the basis of the above stated documents.

All documents, together with originals, must include translation into English signed and stamped by a notary.

To register a new Personal Cabinet, you have to go to the https://viptrade.eu/en/signup. Then enter your e-mail address, full name, mobile phone number, and click "Receive the confirmation code via E-mail". After receiving the code, enter it into the required field and login to your Personal Cabinet.

"Personal Cabinet " service is a convenient and safe way to manage your accounts. In your Personal Cabinet, you can open trading accounts, read detailed information about your operations, view or change the personal information specified during the registration, make internal transfer of funds between your accounts without any commission, find the information about promo offers, and watch our educational materials. More detailed information about the Area can be found on " https://viptrade.eu/en/login" page.

Viptrade guarantees the execution of Stop Loss orders. However, during fast markets or gaps, there is probability of a large slippage.

The 'Stop Loss Level' function provides traders with possibility to automatically close all positions beyond a certain drawdown level of equity. All open positions will be closed, all pending orders will be cancelled and trading blocked if the equity on the account becomes equal to or less than the 'Stop Loss Level' set by the client. Please beware that equity on the account after the closing of all open positions might be lower than the 'Stop Loss Level', depending on market conditions.

No, all trading orders are executed automatically, execution is STP (Straight-Through Processing). In case of an order placed by telephone, the order is entered manually into the trading system for automated execution.

Yes. An ECN trading environment is recognizable by the addition of the following attributes: existence of a marketplace where traders can trade against each other, displaying of the market depth including clients' place bid and place offer orders, variable spreads, STP execution with no dealing desk and competition between various bids and asks placed on the marketplace, same price feed for all participants.

The trading platforms give the trader the option to limit or fully exclude slippage on all market orders. It is to be noted that decreasing tolerance to slippage increases probability of order rejects.

Yes, trading conditions may differ between the environments. This might relate to the list of tradable instruments available, trading settings etc. Although Viptrade strives to ensure that trading conditions on DEMO and LIVE are aligned as much as possible, differences still might appear. This is especially likely to happen when new trading instruments are being released and tested or when special trading conditions are applied to specific instruments.

Yes, all the accounts have direct access to the ECN Forex trading market via Swissquote,Exante,Lmax.

You can open an account using simplified online procedure by sending us scanned copies or readable pictures of uncertified documents. Please be informed, that accounts opened with scanned documents have net deposit limit of 15'000 USD. In order to increase that limit, please contact your Account Manager.

Depending on the services which Viptrade provides to the client, various commissions may apply. Please consult the complete fee schedule published on our website.

Stop Order A stop order is a pending order to buy or sell currency once the price of the currency pair reaches a specified price, known as the stop price. When the stop price is reached, the stop order becomes a market order. A buy stop order is always placed above the current market price, while a sell stop order is placed below. Stop orders can be triggered either by ask or bid price, thus giving traders more flexibility in execution control. For stop orders slippage value of 25 pips is applied by default. If any slippage value is indicated by user, the stop order becomes a stop limit order. That is, if the stop order will fail to execute within the specified slippage range, the order will be automatically transformed into a limit order. Limit Order A limit order is a pending order to buy or sell currency at a specified level or better. A buy limit order can only be executed at the limit price or lower and triggered by ask side, and a sell limit order can only be executed at the limit price or higher and triggered by bid side. Limit orders may fail to execute because the market price may quickly bounce back from the limit price before your order can be filled.

When entering a conditional order you should pay your attention to the current market price, the desired price and inequality sign that you set up in your order. If an order conditions correspond to the current market price the order will be executed immediately. Example: Current market price EUR/USD 1.4310, your conditional order is Buy if >=1.4305. The order will be executed immediately.

Market order is an order to buy or sell currency immediately at the available market price. Market orders are executed according to available bids and offers in the market depth, which indicates volumes available for each price level. When a trade is placed at the market and the order amount is greater than volume of the price offered on the platform, the execution of the remaining amount is split according to the next levels of the market depth. For market orders slippage value of 10 pips is applied by default unless the other value is selected. Should the market price slip more than the specified level, the market order will be automatically cancelled.

There is an mail. Viptrade is ready to help at any open market time. Viptrade emergency mail: [email protected]

Due to security reasons, orders can only be placed via the platform interface or by send email [email protected].

You Might be required to be regulated by your local financial services authority in order to be able to offer Money Manager services in your country. It is your responsibility to check this information before applying to take part in the Money Manager Program.

After you have signed up the counter in your account will show the earned commission which will be paid top your account every ( by you )chosen time interval.

After you have signed up the counter in your account will show the earned commission which will be paid top your account every ( by you )chosen time interval.

Yes, if you are a registered Money Manager with NSFX we will process the fees periodically and they are paid to your Agent account in accordance with the terms agreed between you and your client.

It depends on how quickly you can provide us with the required supporting documents. On average the process takes a couple of days. Once the documents have been submitted, we will aim to contact you within 24 hours. If you do not get a reply within three working days, please send an email to [email protected]

No. The LPOA (Limited Power of Attorney) agreement gives you the right to trade on a client's account but not to withdraw funds. However, if your client gives you his consent, you can submit the withdrawal form on behalf of the client and once processed the withdrawn funds will be sent to the client's bank account.

Your client is responsible for providing the required documents for opening their VIPTRADE Trader account. However, as their Money Manager you can choose to assist your clients by sending these documents on their behalf to us for processing.

Yes, your clients will have access to their trading account(s). Whenever required, VIPTRADE can provide an investor password which will enable your client to have full read-only access to the account.

No, any account that is designated as a "sub" account cannot trade on that account. If a client wishes to self-trade he/she can open up a separate account.

Yes, you can receive commission on your own trading activity for your clients.

Please e-mail [email protected] with your detailed question.

Website terms and conditions

Please find below a comprehensive list of the Terms and Conditions related to the use of our website(s). It is important that you make yourself aware of these and agree to them before using our website(s).

Please read these terms and conditions carefully before using this site

These terms outline the rules for using our website(s) www.viptrade.ge, including any language sites (collectively, ‘Our site’).

Who we are and how to contact us

Our site is owned and operated by VIPTRADE (‘we’, ‘us’, ‘ours’). LLC TRADE HOLDING Information regarding the aforementioned entities can be found on our Site.

For more information on how to contact us click https://viptrade.ge/en/company/contact-us.

By using our site you accept these terms

By using our site you confirm that you accept these terms of use and you agree to comply with them. If you do not agree with these terms you may not use our site and our services.

By continuing to use this site you consent to all the information provided to you in English language (including marketing and other material) unless you have chosen and/or accepted to receive information in more than one language.

Further, by continuing to use the site you consent that the information provided via the site is in a medium, considered as ‘durable medium’, and you agree that due to the nature of the services we offer (i.e. online services) information found online is considered as being in durable form.

There are other terms that may apply to you

The following terms of use also apply when using our site:

We may make changes to these terms

We may make changes to these terms

We may amend these terms from time to time. Every time you wish to use our site please check these terms to ensure you understand the terms that apply at that particular time.

We may make changes to our site

We may update and change our site from time to time. You can find the most up-to-date version of these terms on our site.

We may suspend or withdraw our site

Our site is made available free of charge.

We do not guarantee that our site (including any content and links) will always be available or uninterrupted. We may suspend, withdraw or restrict the availability of of our site or a part of it for business, operational or other reasons. We will try to give you reasonable notice of any suspension or withdrawal.

Any person accessing our site shall be made aware of these terms of use and other applicable terms and conditions.

OUR SITE IS NOT FOR USERS in certain countries including but not limited to the United States of America and Canada and is not intended for distribution or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. From time to time the site may be unavailable or partly unavailable to other countries not listed above. There may also be instances where the site may be available in countries which prohibit the use of this site. In this case, it is the responsibility of the visitor to ensure that the site complies with any local laws or regulations to which they may be subject to. We do not guarantee that the content available on our site is appropriate for use in the location and jurisdiction where this site is accessible.

You must keep your account details safe

If you choose or you are provided with a user identification code, password or any other piece of information as part of our security procedures you must treat such information as confidential. You must not disclose it to any third party.

We have the right to disable any user identification code or password whether chosen by you or allocated by us, at any time, if in our reasonable opinion you have failed to comply with any of the provisions of these terms of use.

If you know or suspect that anyone other than you knows your user identification code or password you must promptly notify us.

How you may use material on our site

We are the owner or the licensee of all intellectual property rights on our site as well as the material published on it including any copyright, database rights and trade marks. Any such right not belonging to us belongs to third parties whom we have obtained their approval for use and are protected by copyright laws and treaties around the world. All such rights are reserved.

Our site contains both public and client areas. The client area is only accessible to clients who have opened an account with us and have been given access to our trading and other platforms.

You must not modify the paper or digital copies of any materials you have printed off or downloaded in any way and you must not use any information or material found on the site in any way. Material on our site is intellectual property belonging to us and you have no right on any such material.

You must not use any part of the content on our site for commercial or any other purpose without obtaining a licence from us or our licensors.

If you print off, copy or download any part of our site in breach of these terms of use we may take the respective action as we deem appropriate.

Do not rely on information on this site

The content on our site is provided for general information only. It is not intended for advice on which you should rely on. Please obtain professional or specialist advice before taking or refraining from any action on the basis of the content on our site.

Although we make reasonable efforts to update the information on our site we do not guarantee that the content on our site is accurate, complete or up to date.

Rules about linking to our site

You must not establish a link in such a way as to suggest any form of association, approval or endorsement on our part where none exists.

You must not establish a link to our site in any website.

Our site must not be framed on any other site, nor may you create a link to any part of our site.

You must not use our domain name or part of it for any use which is not authorised by VIPTRADE.

If you wish to link to or make any use of content on our site other than that set out above, please contact us.

Our responsibility for loss or damage suffered by you

We do not exclude or limit in any way our liability to you where it would be unlawful to do so in our jurisdiction. This includes liability for death or personal injury caused by our negligence or the negligence of our employees, agents or subcontractors.

Different limitations and exclusions of liability will apply to liability arising as a result of the supply of any products to you as set out in our Client Agreement.

To the maximum extent permitted by law, we will not be liable in any way for any loss or damage suffered by you through the use or access to our site or our failure to provide this site.

We exclude all implied conditions, warranties, representations or other terms that may apply to our site or any content on it.

We will not be liable to you for any loss or damage, whether in contract, tort (including negligence), breach of statutory duty, or otherwise, even if foreseeable arising under or in connection with the:

We are not responsible for viruses and you must not infect our site

We do not guarantee that our site will be secure or free from bugs or viruses nor that our site is fit for a purpose.

You are responsible for configuring your information technology, computer programmes and platform to access our site. You should use your own virus protection software.

You must not misuse our site by knowingly introducing viruses, trojans, worms, logic bombs or other material that is malicious or technologically harmful. You must not attempt to gain unauthorised access to our site, the server on which our site is stored or any server, computer or database connected to our site. You must not attack our site via a denial-of-service attack or a distributed denial-of service attack. By breaching this provision, you may commit a criminal offence under applicable legislation. We will report any such breach to the relevant law enforcement authorities and we will co-operate with those authorities by disclosing your identity to them. In the event of such a breach, your right to use our site will cease immediately.

Which country’s laws apply to any disputes?

The governing law and jurisdiction of these terms is set out in the ‘Client Agreement’.

Our trade marks are registered

All copyright, database rights, trade marks and any other intellectual property rights in the content of this site belong to us or a third party including our licensors. The content on our website (in whichever form) may or may not be identified by a symbol. The lack of any such symbol should not be understood as meaning that the name, term or data is not the intellectual property of either ourselves or any third party.

VIPTRADE (in word and stylised forms) have been registered locally as well as internationally. You are not permitted to use them without our approval.

We also have rights in our domain name and you shall not create or use any domain name, which contains the same words or identically similar words to our domain name and specifically, you should not use any words which include the word ‘VIPTRADE’ either alone or with other letters or words.

Additionally, all content on our site is copyrighted. No information or content on this site may be reproduced, adapted, uploaded to a third party, linked, distributed or transmitted in any form or manner.

Amendments

While we have made best efforts to ensure the accuracy of the information on this site the information given on the site is subject to change without any notice. We reserve the right to modify these terms at any time by publishing revised terms of this information. We will not notify anyone and the applicable version will be the most up-to-date one.

Severability

If all or part of a provision of these terms is deemed void, unenforceable or illegal by a court of competent jurisdiction then the remainder of the terms and conditions will have full force and effect and the validity or enforceability of that provision in any other jurisdiction shall not be affected.